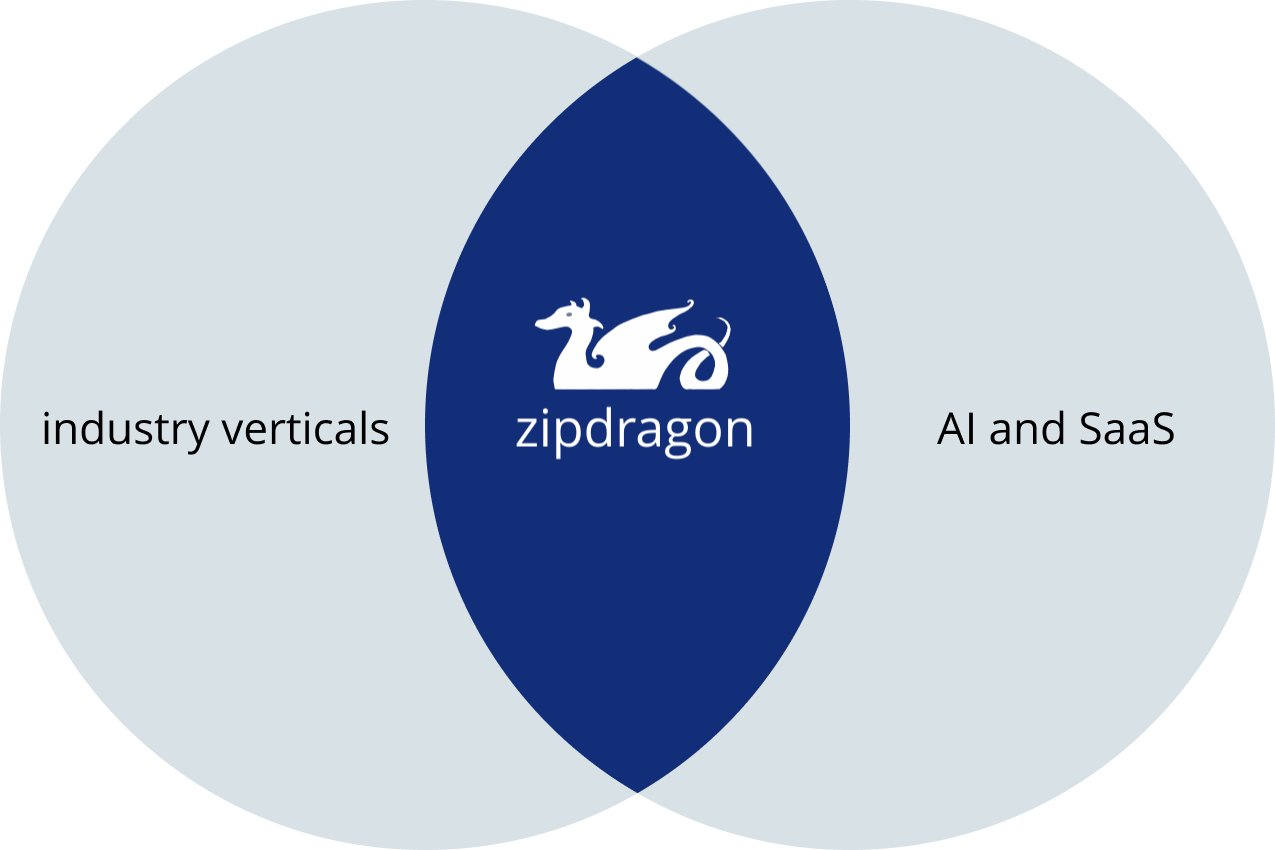

FOCUS

We invest and advise at the intersection of AI, SaaS, and industry-specific solutions

INVESTING

Backing startups in their earliest phases

Investment Approach

zipdragon focuses on startups at the intersection of climate tech and digital, investing in capital efficient early-stage startups addressing meaningful problems.

Focus: AI, SaaS, data, and industry-specific solutions.

Stage: Pre-seed and seed.

Geography: Focus on East Bay, CA, and other underserved innovation hubs.

Capital Efficiency: Favor high-velocity, low-friction sales models.

Expertise: Leverage deep SaaS and industry experience, along with a strong network.

Founders: Back visionary leaders who inspire strong company cultures.

Growth: Companies primed for rapid revenue scaling.

Structure: Lead investment rounds (priced, SAFEs, or convertible notes) and serve on the board.

Collaboration: Build strong syndicates.

ADVISORY

Driving innovation and growth for leading companies and investors

Achievements

As a senior advisor for the corporate venture capital (CVC) arm of a global energy company, led investments into 5 leading startups.

Designed, launched, and operated an open innovation program for a leading energy company, driving adoption of AI, drones, robotics, and other innovations.

Created and implemented a startup sourcing program, building a high-impact partner pipeline for a global industrials company.

Co-developed a pioneering debt fund to finance emerging market solar distributors, expanding access to clean energy in underserved regions.